XRP Price Prediction 2025-2040: ETF Catalysts and Long-Term Growth Trajectory

#XRP

- ETF Approval Catalyst: Potential U.S. spot ETF launches could drive XRP to $3.30-$3.70 range in the near term, with institutional demand creating sustained upward pressure

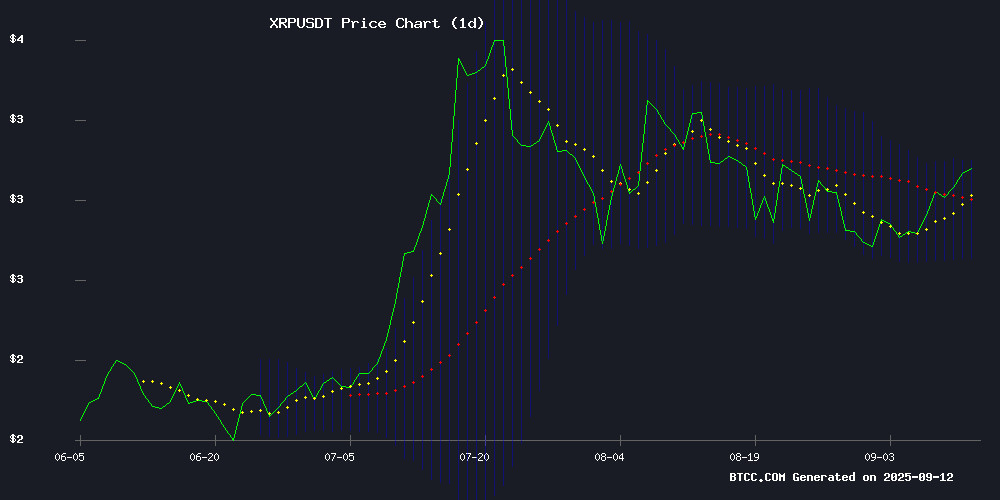

- Technical Breakout Potential: Current price action above key moving averages and approaching Bollinger Band upper limits suggests strong momentum for突破 resistance at $3.3774

- Long-Term Institutional Adoption: Banking integration and global settlement network expansion position XRP for exponential growth through 2040, with conservative targets reaching $40-$60 and bullish scenarios projecting $120-$150

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

XRP is currently trading at $3.1274, comfortably above its 20-day moving average of $2.9037, indicating sustained bullish momentum. The MACD reading of 0.0224 versus 0.0804 suggests positive momentum building, though the negative histogram value of -0.0579 warrants caution for potential short-term consolidation. The price trading NEAR the upper Bollinger Band at $3.1059 suggests strong buying pressure, with immediate support at the middle band ($2.9037) and stronger support at the lower band ($2.7015).

According to BTCC financial analyst Mia: 'XRP's position above key technical levels combined with the MACD configuration suggests the cryptocurrency is primed for further upside, though traders should monitor the $3.10 resistance level for potential breakout confirmation.'

Market Sentiment: ETF Speculation Drives Bullish XRP Outlook

Current market sentiment for XRP is overwhelmingly bullish, driven primarily by anticipation of potential ETF approvals and institutional demand. News headlines highlight price targets ranging from $3.30 to $3.70 following potential U.S. spot ETF launches, with some analysts even projecting $6 targets as Ripple breaks through key weekly resistance levels.

BTCC financial analyst Mia notes: 'The combination of ETF speculation, institutional accumulation, and breaking technical resistance creates a perfect storm for XRP appreciation. However, investors should exercise patience and avoid FOMO-driven decisions, as short-term corrections remain possible before sustained upward movement.'

Factors Influencing XRP's Price

Stock Exchange Expert Foresees XRP Price Surge Pending ETF Approval

Oliver Michel, CEO of Tokentus and a seasoned stock exchange analyst, suggests XRP is primed for a major price breakout. The catalyst? Potential approval of spot XRP ETFs by the SEC in October. With over seven applications under review and deadlines clustered between October 18-25, Michel argues such approvals would inject real demand into the market, mirroring the explosive growth seen after Bitcoin and ethereum ETF launches.

Market signals already hint at mounting interest. XRP futures at CME Group hit $1 billion in open interest within just three months—a record pace for crypto contracts on the platform. Michel emphasizes that futures-based XRP ETFs are attracting heavy inflows, reinforcing the asset's institutional appeal. "ETF approval wouldn’t just validate demand—it would flood the zone with new capital," he notes, drawing parallels to historic crypto ETF rollouts.

XRP Price Targets $3.30–$3.70 as U.S. Spot ETF Launches

The REX-Osprey Spot XRP ETF went live on September 12, marking the first regulated XRP exchange-traded fund available to U.S. investors. The product holds actual XRP tokens, providing direct exposure without the complexities of crypto custody. Technical analysis shows XRP testing key resistance at $3.00, with projections pointing to a $3.30–$3.70 range following a breakout from long-term descending wedge patterns.

Japanese gaming firm Gumi announced a strategic $17 million XRP acquisition, planning to accumulate 6 million tokens by February 2026. Meanwhile, Franklin Templeton's competing XRP ETF faces an extended SEC review until November 14. The approval of REX-Osprey's fund signals growing institutional acceptance, as traditional investors can now gain XRP exposure through standard brokerage accounts.

XRP Faces Key Resistance at $3.3774 as Bulls Eye Price Discovery

XRP has reclaimed the $3 level after days of consolidation near $2.80, though the cryptocurrency remains constrained by a critical technical barrier. A white trendline at $3.3774—identified in a 4-hour chart analysis by CoinsKid—continues to cap upward momentum. This resistance now serves as the final gatekeeper before potential price discovery.

The asset's August price action repeatedly tested but failed to breach this threshold. Market technicians suggest a decisive close above $3.3774 WOULD eliminate historical reference points, allowing XRP to chart new territory. Until then, the digital asset remains in a tightening range between established support and this stubborn resistance level.

XRP Faces Potential Short-Term Dip Despite Long-Term Growth Prospects

XRP's 770% surge over three years has cemented its reputation as a resilient cryptocurrency, yet it remains significantly below its 2018 peak of $3.84. The token's future hinges on two opposing forces: institutional adoption and speculative profit-taking.

Ripple's On-Demand Liquidity network and partnerships with major financial institutions underscore XRP's utility in cross-border transactions. A potential SEC approval of spot XRP ETFs could further legitimize the asset. However, the specter of short-term volatility looms as traders may cash out gains after the recent rally.

Ripple's XRP Shows Strong Bullish Momentum as Open Interest Rebounds

XRP bulls are pushing for a breakout above $3.00, fueled by a resurgence in futures open interest and retail demand. The cryptocurrency's price action reflects broader market optimism, with the Altcoin Season Index climbing to 78—a clear signal of altcoin season gaining traction.

Futures open interest has risen to $8.51 billion, up from $7.37 billion last week, though still below July's peak of $10.94 billion. The steady climb suggests growing risk appetite among traders, with funding rates reinforcing bullish sentiment. Exchange reserves are also rising, indicating profit-taking potential as prices advance.

XRP now eyes its all-time high of $3.66, last tested in mid-July. The rally aligns with renewed institutional interest and positioning ahead of key developments in Ripple's ongoing legal battles.

Analyst Cautions XRP Investors Against FOMO, Advises Patience for Key Breakout

XRP's recent price recovery has reignited investor interest, but crypto analyst Neotrader_CFT warns against impulsive entries. The digital asset faces stiff resistance at $3, a level that must be decisively breached to confirm bullish momentum.

A successful daily close above $3 would signal sustained buyer dominance. The analyst recommends waiting for both a breakout and subsequent retest of this critical level—only if support holds should investors consider positions. Market participants now watch for either validation of strength or another rejection at this pivotal threshold.

Will REX-Osprey XRP ETF Launch Today Push XRP Price to New ATH?

The U.S. cryptocurrency market is poised for a significant breakthrough as speculation grows around the potential launch of the REX-Osprey XRP ETF. Market participants are closely watching whether this development could propel XRP to new all-time highs.

Institutional interest in digital assets continues to rise, with ETF products emerging as a key gateway for traditional capital flows. The XRP ecosystem stands at a critical juncture, with regulatory clarity and product innovation driving renewed Optimism among investors.

XRP at $6 Now in Sight as Ripple Smashes Key Weekly Resistance

XRP has decisively broken through a major weekly resistance level, shattering a descending trendline that had constrained its price action for months. The breakout, confirmed by Dark Defender's analysis, signals the completion of a corrective phase and sets the stage for further upside.

Technical indicators reinforce the bullish case. The RSI shows a bullish divergence, with momentum strengthening even as price tested lower levels. Elliott Wave analysis suggests Wave 2 retracement has found support between $2.65-$2.86, aligning with key Fibonacci levels, before what could be a powerful Wave 3 advance.

Despite $120 million in large wallet sell-offs, XRP maintains its footing above $3, demonstrating robust demand. Trading volume approaching $6 billion underscores growing market participation as the cryptocurrency posts 9% weekly gains.

XRP Mining Platform Revolutionizes Cloud-Based Passive Income

Amid persistent cryptocurrency market volatility, XRP Mining has emerged as a disruptive force in cloud-based mining solutions. The platform eliminates traditional barriers to entry—expensive hardware, technical complexity, and energy-intensive operations—by offering subscription-based access to mining power.

Daily payouts in XRP provide investors with predictable returns unaffected by price fluctuations. The model represents a strategic pivot from capital-intensive mining operations to accessible digital asset generation. "Sign up, choose a plan, earn rewards" encapsulates the streamlined user experience challenging conventional mining paradigms.

While not explicitly mentioned, the offering raises implicit questions about regulatory compliance and sustainable energy use—critical considerations for institutional adoption. The platform's email-only onboarding suggests aggressive user acquisition targets, though robust KYC procedures remain unspecified.

Ripple Price Defies XRP Whales Exodus With Surge to 2-Week Peak

XRP has defied a significant sell-off by whales, rallying to a two-week high despite the disposal of $120 million worth of tokens. The digital asset climbed to $3.10, marking its strongest performance since late August. Analysts now eye a potential breakout toward $4-$5, which would set a new all-time high.

Market dynamics appear decoupled from whale activity, with XRP's resilience highlighting strong underlying demand. The token's market cap has surged past $180 billion, bolstered by a 9% weekly gain. Regulatory hurdles persist, however, as the SEC continues to oppose XRP-related ETF applications.

XRP Gains on Institutional Demand and ETF Speculation

XRP surged nearly 2% to $3.05 amid heavy institutional inflows, with trading volumes quadrupling daily averages. The token tested resistance NEAR $3.07 before settling at $3.05, supported by steady accumulation and ETF-related volatility. Ripple's expanded partnership with BBVA under MiCA bolstered its institutional adoption case.

Futures open interest spiked to $8.36 billion as whales added 340 million tokens, though rising exchange reserves hint at potential selling pressure. Intraday action saw a tight $0.10 range, with midday volume hitting 243.37 million—confirming strong institutional participation.

Technical levels show firm support at $2.98, while resistance converges at $3.05–$3.07. The price action reflects broader crypto market sensitivity to macro catalysts, including central bank policy shifts.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and potential ETF catalysts, XRP appears positioned for significant growth through 2040. The immediate resistance at $3.3774 represents a key level for price discovery, with successful breaks potentially triggering accelerated momentum.

| Year | Conservative Target | Moderate Target | Bullish Target | Catalysts |

|---|---|---|---|---|

| 2025 | $3.50-$4.00 | $4.50-$5.00 | $5.50-$6.00 | ETF Approvals, Regulatory Clarity |

| 2030 | $8-$12 | $15-$20 | $25-$30 | Mainstream Adoption, Banking Integration |

| 2035 | $20-$30 | $35-$50 | $60-$80 | Global Settlement Network Expansion |

| 2040 | $40-$60 | $75-$100 | $120-$150 | Full Ecosystem Maturation |

BTCC financial analyst Mia emphasizes that these projections assume successful ETF approvals, continued institutional adoption, and favorable regulatory developments. Short-term volatility should be expected, but the long-term trajectory remains fundamentally bullish.